Why Does My Tax Return Still Being Processed . Washington — even though the internal revenue service issues most refunds in less than 21 days for taxpayers who filed. Most returns today are processed within three weeks, with many filers receiving their refunds even sooner. Electronically filed form 1040 returns are generally processed within 21 days. If you file your income tax return electronically and opt for direct deposit, you’ll usually get your refund within 21 days. Even if you submit your returns electronically and request direct deposit, the irs still takes additional time to process certain tax returns. If you have filed your income tax return and have not received an income tax refund within a reasonable time, first confirm if you have. Why your tax refund might be delayed.

from savingtoinvest.com

If you file your income tax return electronically and opt for direct deposit, you’ll usually get your refund within 21 days. Most returns today are processed within three weeks, with many filers receiving their refunds even sooner. Even if you submit your returns electronically and request direct deposit, the irs still takes additional time to process certain tax returns. If you have filed your income tax return and have not received an income tax refund within a reasonable time, first confirm if you have. Electronically filed form 1040 returns are generally processed within 21 days. Why your tax refund might be delayed. Washington — even though the internal revenue service issues most refunds in less than 21 days for taxpayers who filed.

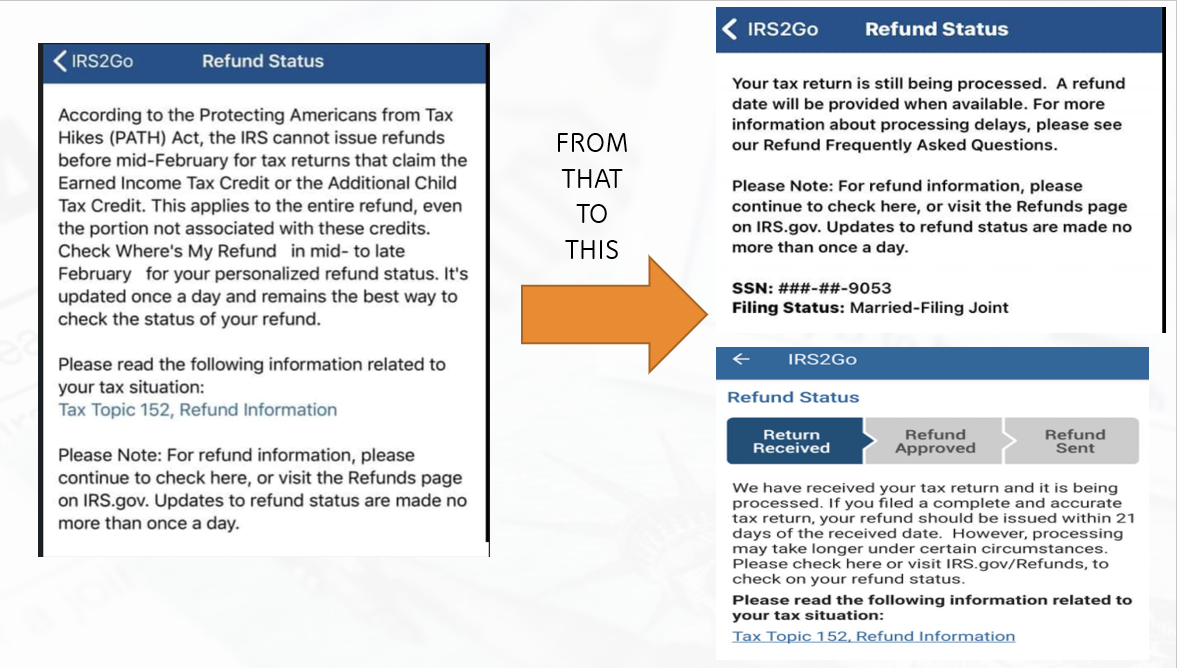

Refund Status Your Tax Return is Still Being Processed and Refund

Why Does My Tax Return Still Being Processed Even if you submit your returns electronically and request direct deposit, the irs still takes additional time to process certain tax returns. Electronically filed form 1040 returns are generally processed within 21 days. If you file your income tax return electronically and opt for direct deposit, you’ll usually get your refund within 21 days. Even if you submit your returns electronically and request direct deposit, the irs still takes additional time to process certain tax returns. Most returns today are processed within three weeks, with many filers receiving their refunds even sooner. Why your tax refund might be delayed. Washington — even though the internal revenue service issues most refunds in less than 21 days for taxpayers who filed. If you have filed your income tax return and have not received an income tax refund within a reasonable time, first confirm if you have.

From www.youtube.com

Why Is My Tax Return Still Being Processed? YouTube Why Does My Tax Return Still Being Processed Even if you submit your returns electronically and request direct deposit, the irs still takes additional time to process certain tax returns. Electronically filed form 1040 returns are generally processed within 21 days. Most returns today are processed within three weeks, with many filers receiving their refunds even sooner. If you have filed your income tax return and have not. Why Does My Tax Return Still Being Processed.

From www.youtube.com

Tax Return Being Processed Means The IRS Received Your Tax Return, But Why Does My Tax Return Still Being Processed Electronically filed form 1040 returns are generally processed within 21 days. Most returns today are processed within three weeks, with many filers receiving their refunds even sooner. Washington — even though the internal revenue service issues most refunds in less than 21 days for taxpayers who filed. Even if you submit your returns electronically and request direct deposit, the irs. Why Does My Tax Return Still Being Processed.

From www.youtube.com

Your tax return is still being processed Still Waiting For My IRS Why Does My Tax Return Still Being Processed Most returns today are processed within three weeks, with many filers receiving their refunds even sooner. Washington — even though the internal revenue service issues most refunds in less than 21 days for taxpayers who filed. If you file your income tax return electronically and opt for direct deposit, you’ll usually get your refund within 21 days. Even if you. Why Does My Tax Return Still Being Processed.

From www.marca.com

Taxes News Latest Taxes Tips, Deductions, Reports and Updates Why Does My Tax Return Still Being Processed If you have filed your income tax return and have not received an income tax refund within a reasonable time, first confirm if you have. Even if you submit your returns electronically and request direct deposit, the irs still takes additional time to process certain tax returns. Washington — even though the internal revenue service issues most refunds in less. Why Does My Tax Return Still Being Processed.

From webnews21.com

Your Tax Return Is Still Being Processed Why Does My Tax Return Still Being Processed If you have filed your income tax return and have not received an income tax refund within a reasonable time, first confirm if you have. Why your tax refund might be delayed. Most returns today are processed within three weeks, with many filers receiving their refunds even sooner. If you file your income tax return electronically and opt for direct. Why Does My Tax Return Still Being Processed.

From www.youtube.com

What does still being processed mean With Tax Topic 152? YouTube Why Does My Tax Return Still Being Processed Electronically filed form 1040 returns are generally processed within 21 days. Even if you submit your returns electronically and request direct deposit, the irs still takes additional time to process certain tax returns. If you file your income tax return electronically and opt for direct deposit, you’ll usually get your refund within 21 days. Most returns today are processed within. Why Does My Tax Return Still Being Processed.

From www.marca.com

IRS Refund Tracker Why is your tax return still being processed? Marca Why Does My Tax Return Still Being Processed Electronically filed form 1040 returns are generally processed within 21 days. Most returns today are processed within three weeks, with many filers receiving their refunds even sooner. Washington — even though the internal revenue service issues most refunds in less than 21 days for taxpayers who filed. If you have filed your income tax return and have not received an. Why Does My Tax Return Still Being Processed.

From www.youtube.com

IRS WMR Status Your tax return is still being processed. YouTube Why Does My Tax Return Still Being Processed Most returns today are processed within three weeks, with many filers receiving their refunds even sooner. Electronically filed form 1040 returns are generally processed within 21 days. Washington — even though the internal revenue service issues most refunds in less than 21 days for taxpayers who filed. Why your tax refund might be delayed. If you file your income tax. Why Does My Tax Return Still Being Processed.

From www.irs.com

Stages of IRS Refund Your Tax Return Still Being Processed Why Does My Tax Return Still Being Processed If you have filed your income tax return and have not received an income tax refund within a reasonable time, first confirm if you have. Even if you submit your returns electronically and request direct deposit, the irs still takes additional time to process certain tax returns. Why your tax refund might be delayed. Electronically filed form 1040 returns are. Why Does My Tax Return Still Being Processed.

From insurancenoon.com

Why Is My Tax Return Still Being Processed? Important Things To Know Why Does My Tax Return Still Being Processed If you have filed your income tax return and have not received an income tax refund within a reasonable time, first confirm if you have. If you file your income tax return electronically and opt for direct deposit, you’ll usually get your refund within 21 days. Most returns today are processed within three weeks, with many filers receiving their refunds. Why Does My Tax Return Still Being Processed.

From www.taxestalk.net

Why Do My Taxes Still Say Processing Why Does My Tax Return Still Being Processed Why your tax refund might be delayed. Washington — even though the internal revenue service issues most refunds in less than 21 days for taxpayers who filed. Most returns today are processed within three weeks, with many filers receiving their refunds even sooner. If you have filed your income tax return and have not received an income tax refund within. Why Does My Tax Return Still Being Processed.

From www.youtube.com

Tax Refund 2023 STILL BEING PROCESSED TAX RETURN? TAX RETURN STILL Why Does My Tax Return Still Being Processed Even if you submit your returns electronically and request direct deposit, the irs still takes additional time to process certain tax returns. If you file your income tax return electronically and opt for direct deposit, you’ll usually get your refund within 21 days. Most returns today are processed within three weeks, with many filers receiving their refunds even sooner. Why. Why Does My Tax Return Still Being Processed.

From issuu.com

Your tax return is still being processed. refund date will be provided Why Does My Tax Return Still Being Processed Why your tax refund might be delayed. Even if you submit your returns electronically and request direct deposit, the irs still takes additional time to process certain tax returns. If you file your income tax return electronically and opt for direct deposit, you’ll usually get your refund within 21 days. Electronically filed form 1040 returns are generally processed within 21. Why Does My Tax Return Still Being Processed.

From www.youtube.com

Why is my tax return still being processed? YouTube Why Does My Tax Return Still Being Processed Washington — even though the internal revenue service issues most refunds in less than 21 days for taxpayers who filed. Even if you submit your returns electronically and request direct deposit, the irs still takes additional time to process certain tax returns. If you have filed your income tax return and have not received an income tax refund within a. Why Does My Tax Return Still Being Processed.

From refundtalk.com

IRS Still Being Processed vs. Being Processed ⋆ Where's my Refund Why Does My Tax Return Still Being Processed If you file your income tax return electronically and opt for direct deposit, you’ll usually get your refund within 21 days. Why your tax refund might be delayed. Most returns today are processed within three weeks, with many filers receiving their refunds even sooner. Washington — even though the internal revenue service issues most refunds in less than 21 days. Why Does My Tax Return Still Being Processed.

From www.youtube.com

Why is my tax return still being processed after 21 days? YouTube Why Does My Tax Return Still Being Processed Why your tax refund might be delayed. Most returns today are processed within three weeks, with many filers receiving their refunds even sooner. If you file your income tax return electronically and opt for direct deposit, you’ll usually get your refund within 21 days. Washington — even though the internal revenue service issues most refunds in less than 21 days. Why Does My Tax Return Still Being Processed.

From insurancenoon.com

Why Is My Tax Return Still Being Processed? Important Things To Know Why Does My Tax Return Still Being Processed Most returns today are processed within three weeks, with many filers receiving their refunds even sooner. Even if you submit your returns electronically and request direct deposit, the irs still takes additional time to process certain tax returns. Washington — even though the internal revenue service issues most refunds in less than 21 days for taxpayers who filed. Why your. Why Does My Tax Return Still Being Processed.

From en.as.com

Why is my tax return still being processed? AS USA Why Does My Tax Return Still Being Processed Even if you submit your returns electronically and request direct deposit, the irs still takes additional time to process certain tax returns. Why your tax refund might be delayed. Most returns today are processed within three weeks, with many filers receiving their refunds even sooner. Washington — even though the internal revenue service issues most refunds in less than 21. Why Does My Tax Return Still Being Processed.